Installation and operating costs

Costs dialog in economic evaluation defines all the initial charges and running costs of the system in order to calculate total investment, yearly cost and energy cost.

Costs can be defined globally, by pieces, by installed Wc or by m².

You can work with any currency, and pass from one to another by a selection in the list box. The button Rates allows to adjust their relative parity. Choosing one of them as a reference, you can manually modify or download from internet the exchange rates or add new currencies.

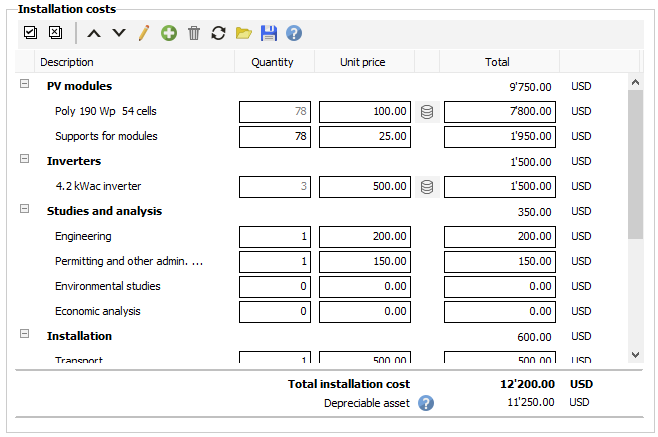

Installation costs

This section determines direct and indirect installation costs of the system.

This includes component costs (modules, inverters, batteries, pumps, controllers, generator), expenses for studies and analysis, administrative fees (grid-connection cost, bank charges, permitting, taxes), insurances, land costs, substitution credit and subsidies. The number and type of PV involved components (PV modules, inverters, batteries, etc.) are automatically updated from the simulation parameters.

Depreciable asset

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value. The yearly depreciation allowance is tax deductible and decreases the taxable amount.

None: depreciation is not taken into account in the financial results

Straight-line: the value of depreciable assets is reduced uniformly each year until it reaches its salvage (residual/scrap) value.

Annual depreciation allowance = (Depreciable assets - Salvage value) / Depreciation duration

Example : for a 120 000$ depreciable assets amount, with a salvage value of 20 000$ at the end of project life and an asset accounting life of 10 years, the yearly depreciation allowance would be (120 000 - 20 000) /10 = 10 000 $.

Declining balance: accelerated depreciation method that records larger depreciation expenses during the earlier years of depreciable assets life, and smaller ones in later years. This calculation method uses the straight-line depreciation rate and a depreciation coefficient :

Straight-line rate = 1 / Project life

Declining balance rate = Straight-line rate x Depreciation coefficient

Annual depreciation allowance for year t = Residual asset value for year t x Declining balance rate

When the depreciation allowance becomes lower than the straight-line depreciation allowance, the straight-line method is applied for last years of the project.

Component and accessories costs are set as depreciable by default in Pvsyst.

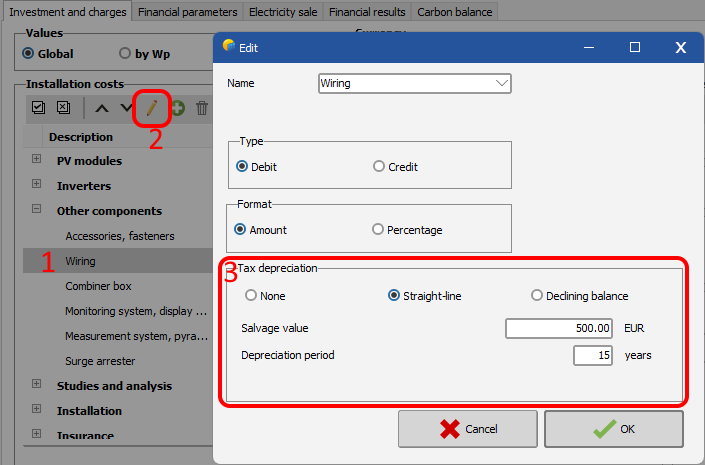

To define depreciation parameters for each asset :

- click on a cost to select it

- click on edit button (pen)

- select a depreciation method (straight-line or declining balance) from the opening dialog, depending on your country and tax system

- set the salvage value (total estimated residual value of the asset at the end of the project)

- set the depreciation period (time over which the asset is expected to be useful). Each asset has a specific depreciation duration defined by your tax system.

- click on OK

Add/delete/update costs

The predefined cost list is fully customizable to take into account any specific cost of your system which is not present in the predefined list. You can add, remove, reorder or rename costs. You can also save defined cost list as template in order to reuse them in another project.

Selects all the investment costs to be deleted, edited or moved.

Unselects all the selected costs. This button is disabled if no cost is selected.

Moves up selected costs. The investment costs list displayed in the printed report uses this order. This button is disabled if no cost is selected.

Moves down selected costs. The investment costs list displayed in the printed report uses this order. This button is disabled if no cost is selected.

Opens the installation cost edition dialog to update properties (name, section, type) of a selected cost. This button is disabled if no cost is selected or more than one cost are selected.

Opens the installation cost edition dialog to add a custom cost if it is not existing in the predefined list.

Deletes selected installation costs from the list. This button is disabled if no cost is selected.

Restores installation costs to Pvsyst default predefined cost list.

![]() Load installation costs from template

Load installation costs from template

Loads cost list from a previously saved template file.

![]() Save installation costs as template

Save installation costs as template

Saves all defined installation costs in a template file in order to be reused later or in a different project.

Prices can be defined for each component. When clicking this button, you may define your own prices for the components used, either for one piece, or discount price for several pieces. These prices may be either saved in your component library, or just kept for the current session, without modifying the component database. Prices can also be defined globally in price list dialog from component database. |

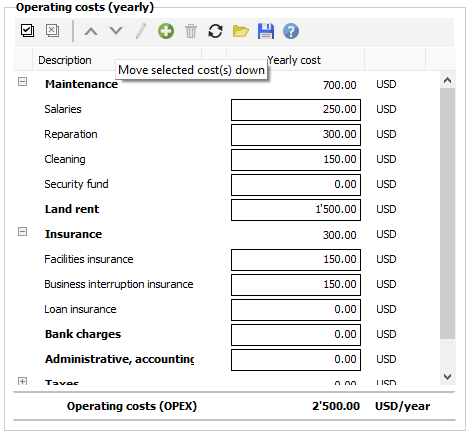

Operating costs

This section defines the annual running expenditures of the system.

The predefined cost list depend on the system type.

- For a grid-connected system, usually very reliable, they are limited to an annual inspection, eventually some cleaning of the collectors and the insurance fees. Some Inverter suppliers provide a long-term payable warranty, including replacement, which are assimilable to an insurance.

- For a stand-alone system, one should add a provision for the maintenance and periodical replacement of the batteries. This last contribution is calculated by the program as a function of the expected lifetime of the battery pack, calculated by the simulation. Moreover, when using an auxiliary generator the program computes the used fuel cost.

- For pumping systems, there is also a provision for pump replacement, their lifetime being usually of the order of a few years. And of course for the batteries when used in the system.

As for installation costs, operating costs are fully customizable to fit the specific needs of your system. The total sum of operating costs is called OPEX (for Operational Expenditure).

Selects all the operating costs to be deleted, edited or moved.

Unselects all the selected costs. This button is disabled if no cost is selected.

Moves up selected costs. The operating costs list displayed in the printed report uses this order. This button is disabled if no cost is selected.

Moves down selected costs. The operating costs list displayed in the printed report uses this order. This button is disabled if no cost is selected.

Opens the operating cost edition dialog to update properties (name, section, type) of a selected cost. This button is disabled if no cost is selected or more than one cost are selected.

Opens the operating cost edition dialog to add a custom cost if it is not existing in the predefined list.

Deletes selected operating costs from the list. This button is disabled if no cost is selected.

Restores operating costs to Pvsyst default predefined cost list.

![]() Load operating costs from template

Load operating costs from template

Loads cost list from a previously saved template file.

![]() Save operating costs as template

Save operating costs as template

Saves all defined operating costs in a template file in order to be reused later or in a different project.

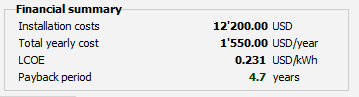

Financial summary

The Total yearly cost is the sum of running costs and loan annuities (defined in Financial Parameters). It is an annual average value on project duration including the inflation rate if defined.

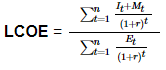

The LCOE (Levelized Energy Cost) is the price of the produced kWh. It takes into account the present value of future cashflows by applying a Discount Rate.

The formula used in Pvsyst for LCOE calculation is :

It = Investment and expenditures for the year (t)

Mt = Operational and maintenance expenditures for the year (t)

Et = Electricity production for the year (t)

r = Discount rate that could be earned in alternative investments

n = Lifetime of the system

The Payback period is the duration required to recover the initial investment.