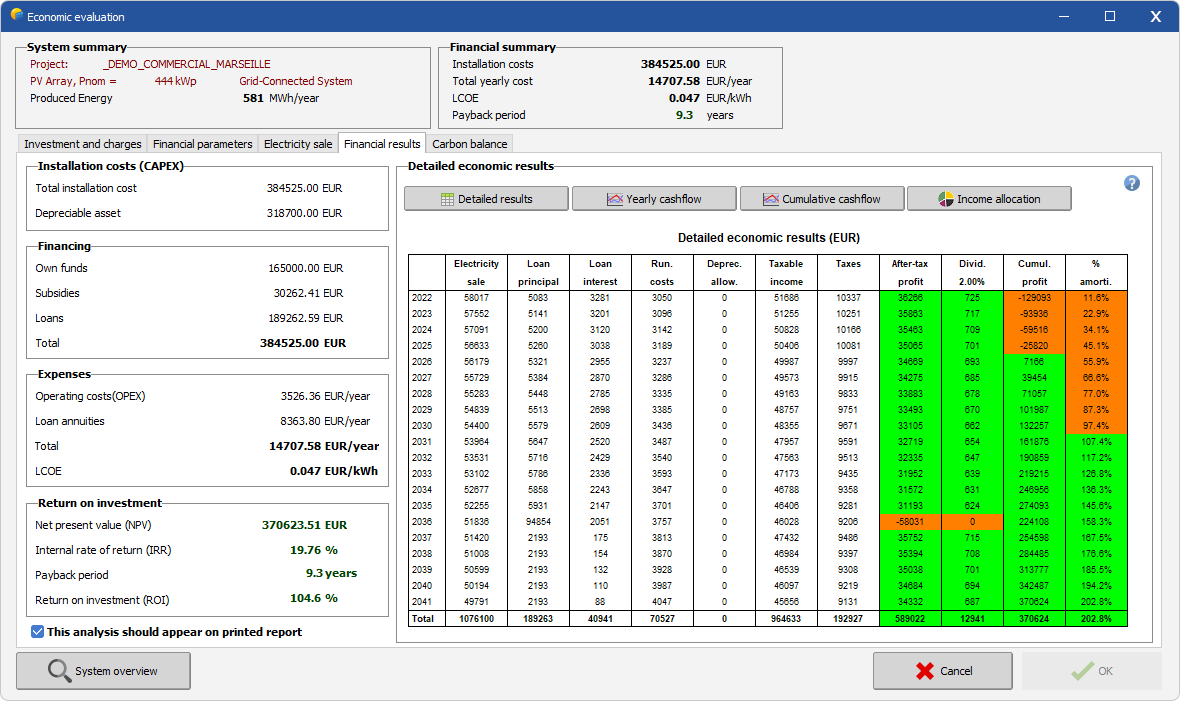

Financial results

This section summarize the profitability of the system. The most important results for makers are the net present value, the payback period and the return on investment ratio.

It also details annual balances between costs defined in Installation and operating costs section and revenues according to the pricing strategy defined in Tariffs section.

Detailed results and calculations methods

Depreciation: transfer of a portion of the installation cost from the balance sheet to the income statement during each year of the system's life. Depreciable part of the installation is defined in Installation and operating costs section. Depreciation calculation depends on the type of depreciation applied for the system (straight-line or declining balance) and defined in Financial Parameters section.

Taxable income: annual amount on which the income tax rate is applied. There are many different and complex tax systems in the world. In most of them, interest part of the loan and equipment depreciation are tax-deductible. Pvsyst tax calculation is based on this method.

Taxable income = Energy Sale Income - Running Costs - Loan Interests - Depreciation

After-tax profit: net income after charges and tax payment. This amount is the base for dividend calculation.

After-tax profit = Energy Sale Income - Running Costs - Loan annuity - (Taxable Income * Income Tax Rate)

Self-consumption saving: saving made on electricity bill by consuming produced energy. It represents the amount that would have been paid for buying the same energy from grid:

Self consumption saving for year t = Energy consumed from own production during year t x Consumption tariff

Payback period: duration in years required to recover the cost of the net investment defined in Installation and operating costs section. If the system is not profitable (more expenses than income), the payback period is undefined.

The amount recovered each year is calculated by the formula :

Recovered amount for year t = Net balance of year t + Self-consumption saving for year t + Redemption part of the loan for year t

Net balance of the year corresponds to the after-tax profit minus possible dividend payments.

Redemption part of the loan is the capital repayment of the borrowed amount (annuity excluding interest part).

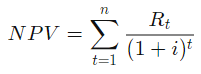

Net present value (NPV): the difference between the present value of cash inflows and the present value of cash outflows over a period of time

Rt = Net balance (income - expenses) for the year (t)

i = Discount rate that could be earned in alternative investments

Et = Electricity production for the year (t)

n = The lifetime of the system

Internal Rate of Return (IRR): value of the discount rate that makes the net present value (NPV) of all cash flows equal to zero

Return on investment (ROI): ratio of net benefit against the initial investment which measures system profitability. A negative ROI indicates that the system is not profitable.

ROI ratio = Net benefit at the end of lifetime / Total investment

PVsyst calculations

Using the effective production given by the simulation, PVsyst shows the annual balance as well as the accumulated balance over the foreseen lifetime of the PV system, according to all these strategies. It also shows details on an annual table.

But be careful: these balances result in differences of large quantities, and little perturbations either on the real production or the effective costs may result in dramatic deviations of the final profitability !

This is namely the case for the annual real irradiance variations, with respect to the weather data used in the simulation. Failures of the system all over its lifetime may also significantly affect the effective balance.